|

Upcoming Forums:

BSA-Fraud

- Oct 17 - 18, 24 - TBD,

[Register] - Apr 10 - 11, 25 - TBD,

[Register]

Business Banking

- Jun 6 - 7, 24 - Charleston, SC

[Register] [Agenda] - Dec 9 - 10, 24 - TBD,

[Register]

Call Center

- Sep 19 - 20, 24 - TBD,

[Register] - Mar 27 - 28, 25 - TBD,

[Register]

CCO

- Apr 29 - 30, 24 - Scottsdale, AZ

[Register] [Agenda] - Oct 21 - 22, 24 - TBD,

[Register]

CEO

- Jun 2 - 4, 24 - Charleston, SC

[Register] [Agenda] - Sep 8 - 10, 24 - TBD,

[Register]

CFO

- Sep 5 - 6, 24 - Denver, CO

[Register] [Agenda] - Jan 30 - 31, 25 - TBD,

[Register]

CIO

- May 30 - 31, 24 - Scottsdale, AZ

[Register] [Agenda] - Dec 12 - 13, 24 - TBD,

[Register]

Commercial Banking

- May 6 - 7, 24 - Boston, MA

[Register] [Agenda] - Oct 31 - 1, 24 - TBD,

[Register]

Digital

- Sep 26 - 27, 24 - TBD,

[Register] - Apr 3 - 4, 25 - TBD,

[Register]

ERM

- May 23 - 24, 24 - Denver, CO

[Register] [Agenda] - Nov 18 - 19, 24 - TBD,

[Register]

HR Director

- Sep 30 - 1, 24 - TBD,

[Register] - Apr 7 - 7, 25 - TBD,

[Register]

Marketing

- Sep 18 - 18, 24 - TBD,

[Register] [Agenda] - Mar 26 - 26, 25 - TBD,

[Register]

Operations

- Sep 23 - 24, 24 - TBD,

[Register] - Mar 31 - 1, 25 - TBD,

[Register]

Payments - Forums

- Jun 10 - 11, 24 - TBD,

[Register] [Agenda] - Jan 27 - 28, 25 - TBD,

[Register]

Retail Banking

- Sep 16 - 17, 24 - TBD,

[Register] - Mar 24 - 25, 25 - TBD,

[Register]

Third Party Risk

- Jan 23 - 24, 25 - TBD,

[Register]

Treasury Management

- May 2 - 3, 24 - Scottsdale, AZ

[Register] [Agenda] - Oct 28 - 29, 24 - TBD,

[Register]

Wealth Management

- Sep 12 - 13, 24 - Santa Fe, NM

[Register] [Agenda] - Feb 3 - 4, 25 - TBD,

[Register]

BirdsEye View

chase's vision for solving for optimizing the retail modelBanks have expressed wariness of the success of FinTechs in gathering deposits in recent years. These organizations appear to be growing faster than our industry, building share and “eyeballs”, and yet, none has shown meaningful profits. In fact, even many of those that have been acquitted by larger banks, such as Simple and BBVA, ended up sunsetting. Fintechs traditionally focused on a narrowly defined product line and consumer segment. That, coupled with their never-ending quest for significant headcount growth, have proven to significantly impact both customer retention and market valuation.

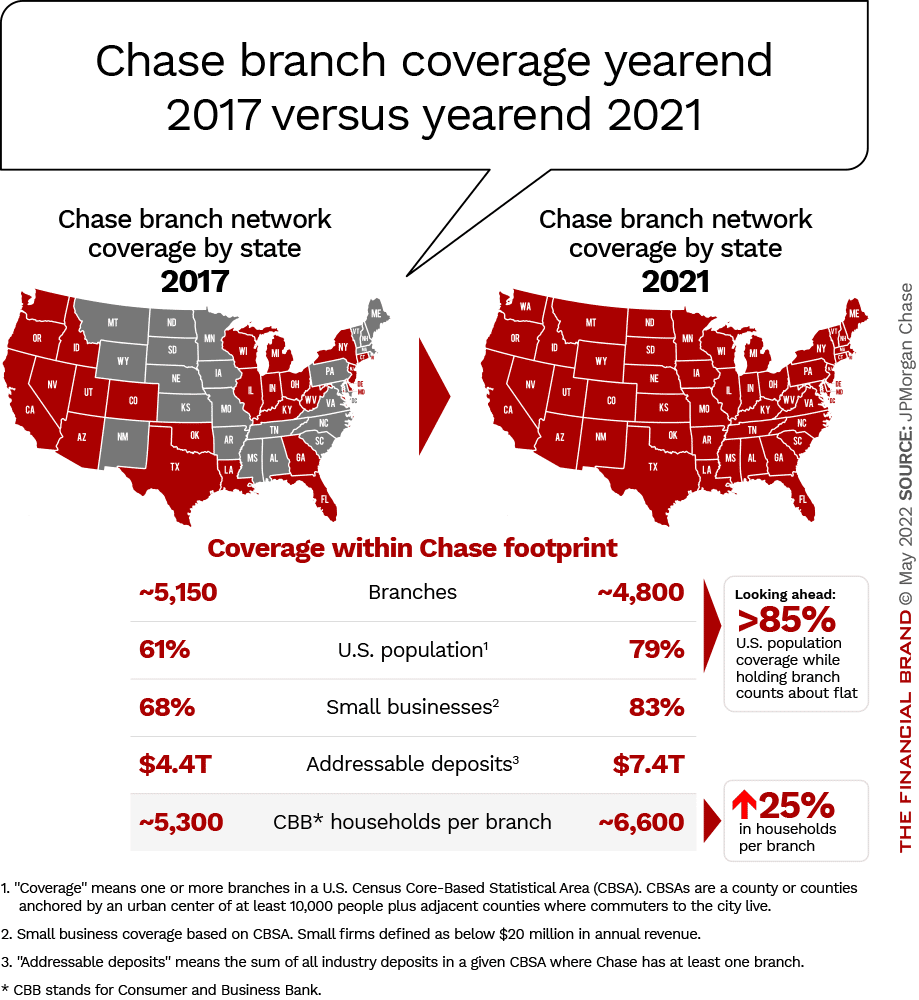

JP Morgan Chase has taken the opposite route to retail banking execution, and its strategy appears to have led to great success. Many of us consider their approach unapplicable to our banks due to the resource limitations we all face, especially relative to the biggest bank in the world. I posit we can certainly draw lessons learned from the Chase strategy and execute elements of it while staying true to our brand promise and within resource constraints.

Chase’s approach to retail banking is the exact opposite of the mono line, all-digital competitors. In fact, Chase focused on offering an extremely broad product line to its retail households, a smart move considering this is a major vulnerability of their Digital competitors. Chase offers over 35 banking and payments services that many consumers and small businesses consider essential, all available from all Chase distribution channels and outlets. This is an intentional and highly effective competitive move from Chase, and all banks can emulate that move (broadening their product line and channel choices) when it comes to competing with FinTech consumer offerings.

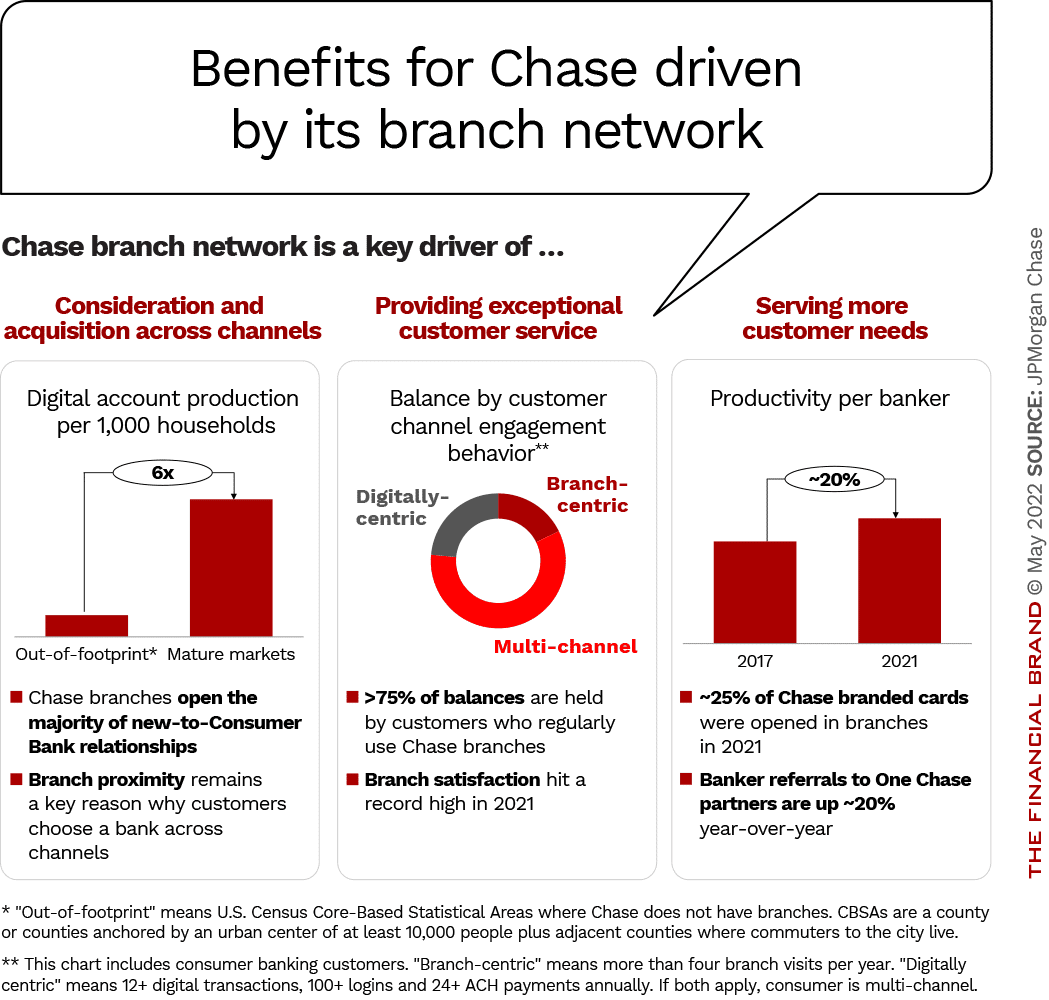

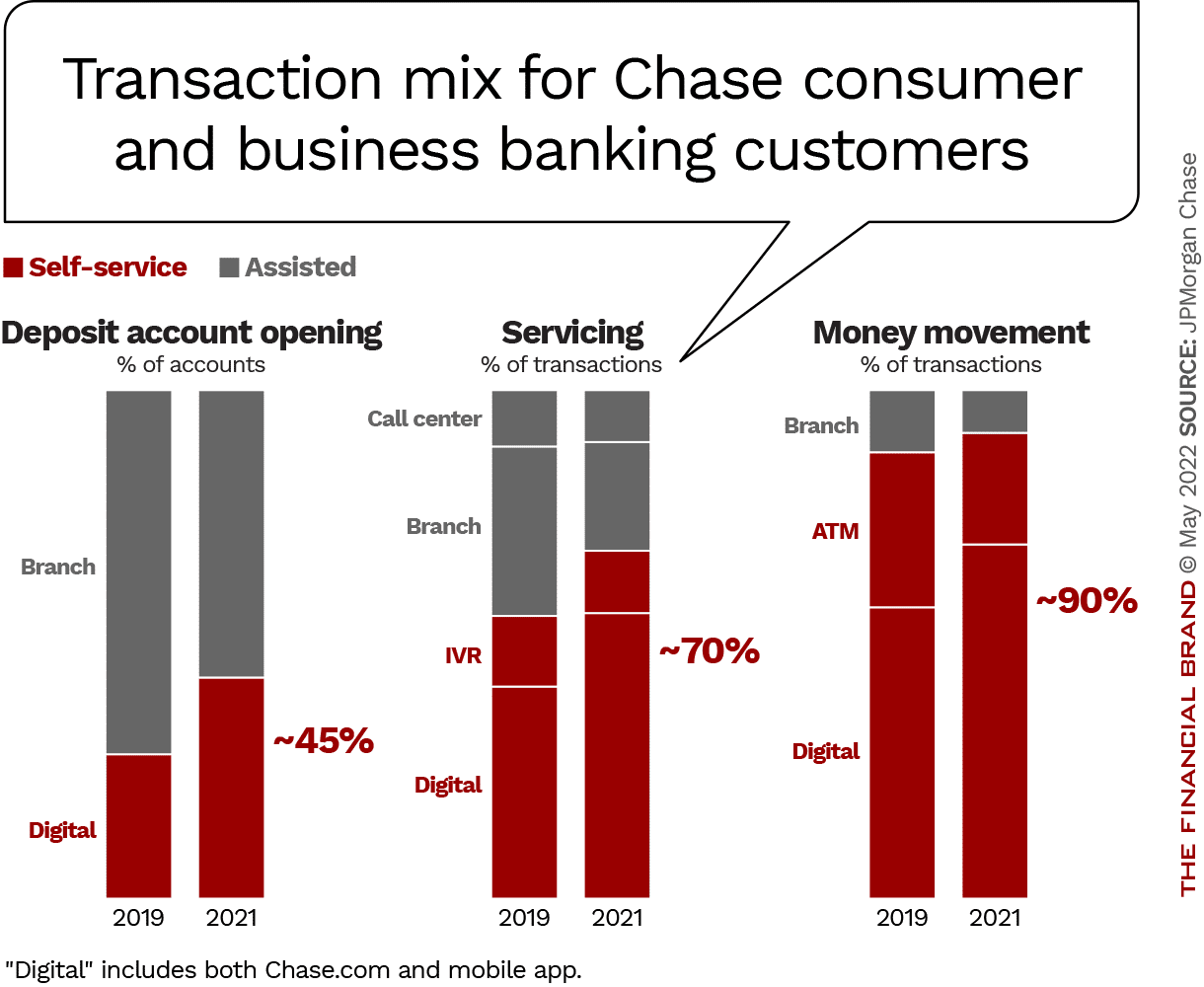

Chase’s long-term mobile-forward strategy has also been paying dividends. Mobile-active customer count has increased 35% since 2019. Over 50% of those customers use at least one financial tool offered by Chase. The surprise, though, is that 70% of the bank’s customers visited a branch in 2021 and 20% met with a banker to discuss their financial needs. These numbers persist across generations and age- groups.

Chase has always had a three-pronged strategy in the consumer and business banking space:

- digital technology and product development;

- distribution, which includes marketing, especially for credit cards;

- and expanding its branch network.

Chase’s philosophy is that, rather than being seen as substitutes for one another, digital and conventional banking channels should complement each other. While the role of each is evolving, but both remain necessary to its success. As we observe other forms of innovation, this approach resonates. When radio was invented, newspapers didn’t disappear. Well over a millennium post-innovation, print readership has declined markedly, but the tail is still strong and it has not disappeared. Similarly, when moving pictures were introduced, radio didn’t die. It simply morphed and continues to do so until today and beyond. Ditto for TV and streaming.

“Customers are using self-service channels for more of their day-to-day needs across account opening, servicing and money movement transactions,” said Chase’s co-head of consumer and business banking Marianne Lake. “We strengthened our model by investing in digital channels to provide more services and improve customer experiences.” Customer satisfaction scores prove the point, and also demonstrate that multi-channel usage leads to higher satisfaction across all channels, an important point for all of us to consider. Digital banking doesn’t replace the branch experiences for most customers. It simply enhances it.